Photo credit : jetcityimage / 123RF

Amazon rolled out its Prime subscription service in Singapore just in time for the Christmas holiday, following the launch of the Prime Now fast delivery app in July. But these moves might not have been enough to tempt shoppers away from local ecommerce options.

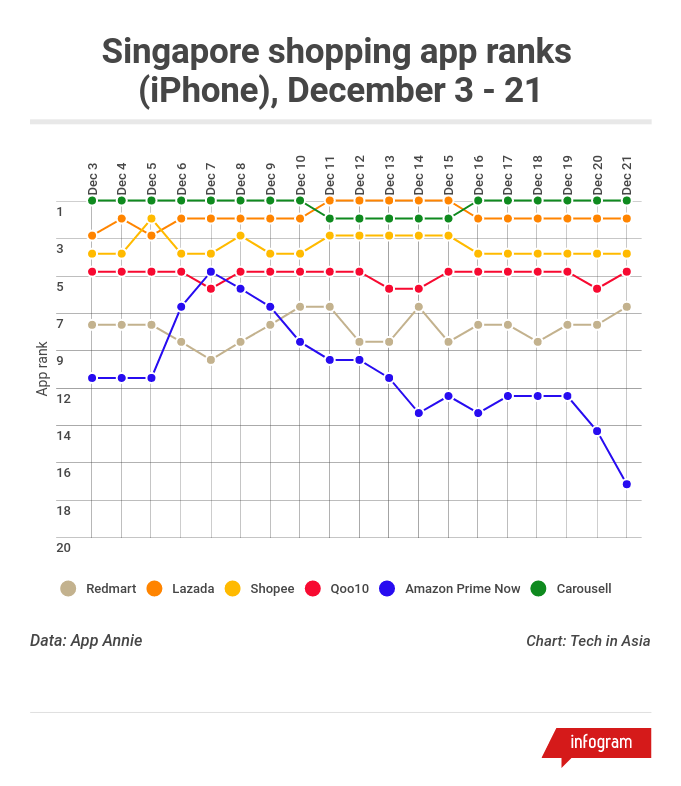

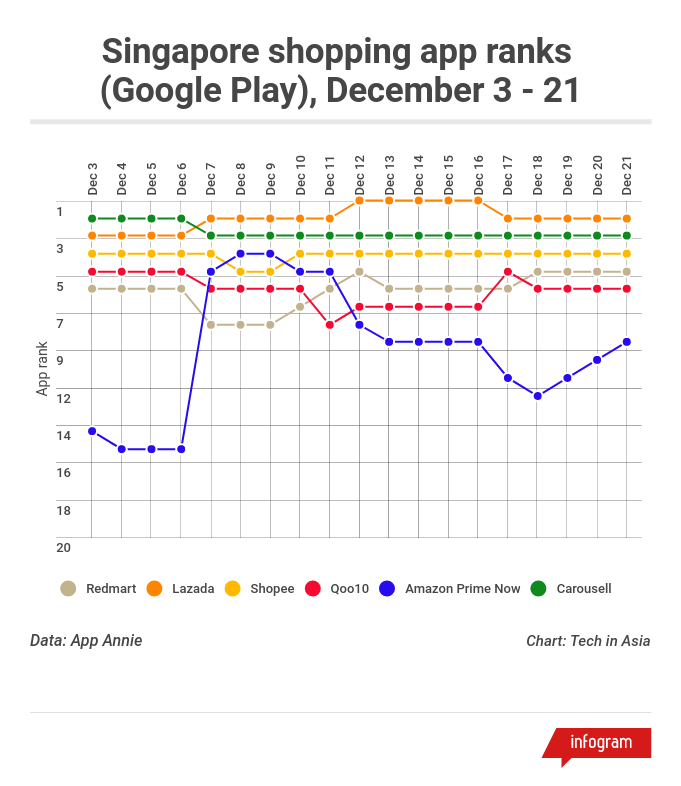

While neither Amazon nor its competitors like to get too descriptive with their numbers, the latest data shows that Amazon is ranking below local rivals like Lazada in the shopping category of both the Android and iOS app stores.

However, app rankings do not tell the whole story. Amazon is currently not firing on all cylinders in Southeast Asia. It still has a chance to catch up, if it decides to add heat to the simmer.

Just a scratch

According to data gathered by App Annie, Amazon Prime’s rank rose sharply on December 7, just after the service launched, before slipping back down to double digits a couple of days later.

Meanwhile, Lazada – Amazon’s Alibaba-backed competitor – has enjoyed a consistently high ranking throughout the month, peaking at #1 in the shopping category between December 12 and 15. This is likely due to the 12.12 promotion, a sales event similar to Singles Day and Black Friday, in which several other websites participated but Amazon skipped.

The app also wasn’t able to surpass the rankings of other competitors like Qoo10, Shopee, and Redmart.

It’s a very different picture compared to July and August, when the Prime Now app enjoyed top-5 positions (although it was freely available to all users at the time).

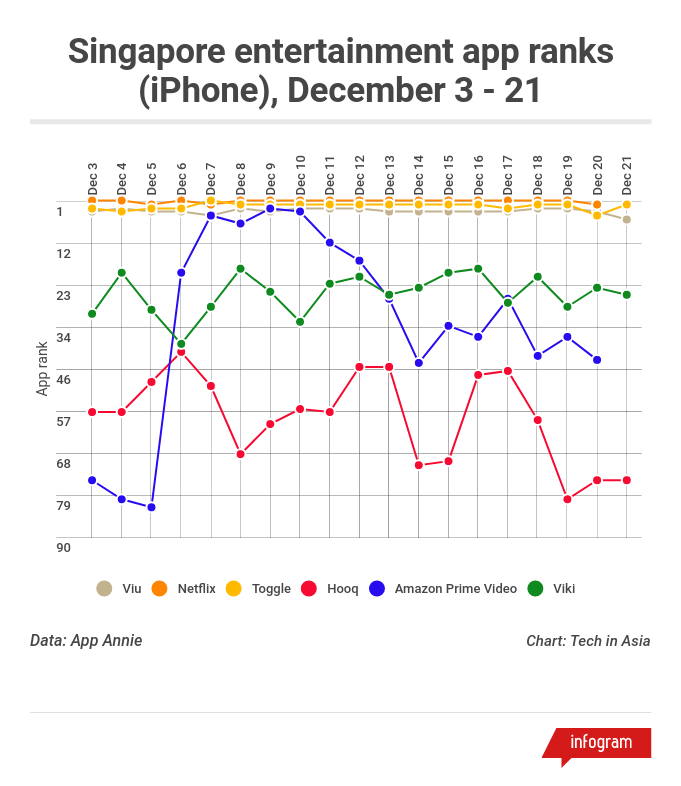

The situation is similar in the entertainment category rankings, where Prime Video doesn’t quite reach the heights of global competitor Netflix and local streaming services Toggle and Viu. None of those apps show any dips in the rankings as a result of Amazon’s product availability.

Android is the mobile platform of choice in Singapore. In 2017, it had a market share of 60 percent, while iOS captured 27.4 percent of the market, according to Statcounter.

Prime Video is part of Amazon Prime’s subscription, which costs S$8.99 per month (currently offered at S$2.99 per month). Amazon also offers a 30-day free trial period, which is probably ongoing for most users, considering the service launched in early December. For what’s effectively a free service, the low app ranking raises an eyebrow.

One possible reason for this is its readiness for the market. Much like Netflix when it launched in Singapore in early 2016, Amazon’s catalog is still not large or localized enough.

Netflix worked hard to rectify that in the past couple of years – it follows that Amazon will be doing the same in the future. The US giant needs to move fast; its rivals are not minnows.

Lazada CEO Max Bittner has previously said his company can fight off competitors, thanks to Alibaba’s deep pockets and its own emphasis on logistics and fulfillment. “Alibaba [is] here to stay. We’re here to stay. [We’ll focus] on what distinguishes us, and we’ll match whatever we can match,” he told the audience at Tech in Asia Jakarta 2017 in November.

Amazon should focus on its ecosystem to provide a meaningful alternative to its competitors in Singapore.

As part of NYSE-listed Sea, Shopee is also in a strong position to defend its turf, with its parent company raising US$894 million through its IPO, on top of more than US$1.5 billion across a number of private rounds.

In terms of sheer numbers, competitors like Lazada and Shopee have more to offer shoppers at the moment. “These two local marketplaces are well established with a lot more product options,” explains Xiaofeng Wang, senior analyst at Forrester. “Consumers don’t find strong motivations to switch, unless they have the urgency to go with Amazon Prime Now’s two-hour delivery.”

All’s not lost for the US giant

The fact that Amazon is lagging behind its rival at the moment is not surprising. “Amazon only has its mobile app, Prime Now, available in Singapore – not the marketplace,” says Wang.

Indeed, most Singaporean shoppers buying stuff on Amazon are used to the US site, which until recently would offer free shipping to the city-state for orders above a certain value. With the Prime subscription launch in Singapore, that’s now over.

Because Amazon’s offering in Singapore is at the moment confined in the Prime mobile and video apps, shoppers seem dissatisfied with the limited product range on offer.

That said, it seems that the sheer brand power of Jeff Bezos’ joint was enough to rank Prime among the country’s most popular ecommerce and entertainment apps.

Also, Amazon has not really engaged in sales and promotions so far. “Amazon hasn’t done much marketing and promotion campaigns in the local market since [launch], while Lazada and Shopee both participated in 12.12,” notes Wang.

Despite this, an Amazon spokesperson tells Tech in Asia the company is “thrilled with customer reaction to Amazon’s arrival in Singapore, including the launch of Prime.”

The US firm says it doesn’t focus on competitors – it obsesses over customers instead. “In every country where Amazon operates, there is a lot of competition. But we believe competition is good for customers. At the same time, we feel good about our ability to offer this unique and valuable program to our customers in Singapore,” adds the spokesperson.

Before Amazon landed in the Lion City, Lazada got busy launching a quasi-competitor to Prime. Called LiveUp, it’s a subscription service that combines Lazada and its online grocery Redmart, as well as Taobao, Netflix, and Uber. Subscribers get benefits like free shipping, discounts, rebates, and other freebies.

While Lazada doesn’t share figures on LiveUp subscriptions, the S$49.90 annual fee is an attractive proposition for users of the aforementioned services. The Prime subscription could be appealing as well, but not with several elements still missing, like Prime Music and Prime Reading.

Amazon’s Singapore fulfillment center, which opened in July with the launch of Prime Now. Photo credit: Tech in Asia

Storming the castle

Wang believes Amazon should focus on its ecosystem to provide a meaningful alternative to its competitors in Singapore. “Consumers would be interested in Amazon’s unique products such as Echo, Kindle, digital books. Amazon should play by its strengths and provide the marketplace with more product options to local consumers,” she stresses.

Some industry watchers think Amazon could accelerate its presence in Singapore and Southeast Asia by acquiring local companies.

“With time running out for a full-fledged, organic entry into the high-growth markets of Southeast Asia, its stock trading at all-time high, and not too distant memories of failure in China, we expect Amazon to attempt at least one major acquisition in 2018 to accelerate its regional expansion,” writes Sheji Ho, group chief marketing officer at ecommerce enabler aCommerce.

Amazon does not discuss its plans for the region but there’s probably more services and products on the way. As the company spokesperson says, “While we can’t provide details yet about future Prime benefit additions, we can safely say that we aren’t done. We will keep making Prime better and better in Singapore, adding more selection, finding ways to make it faster, and adding more benefits including great quality entertainment.”

This post Amazon Prime hasn’t made a huge dent in Singapore, but it’s early days appeared first on Tech in Asia.

from Tech in Asia https://www.techinasia.com/amazon-prime-singapore-december-2017

via IFTTT

No comments:

Post a Comment