Photo credit: Stripe.

Online payment service provider Stripe has been making waves in Asia for the past year. It launched in Singapore and Japan in the second half of 2016 and announced its arrival in Hong Kong this week.

The startup has been building up its platform to accept more types of payment, including several ewallets around the world. Its latest deals with Chinese services Alipay and WeChat Pay give Stripe’s businesses access to a huge base of potential customers.

Launched by Patrick and John Collison in 2011, Stripe has raised over US$450 million in funding and is currently valued at US$9.2 billion. The brothers learned to code in their parents’ home near Limerick, Ireland, reading programming books and one-upping each other.

Stripe’s deals with Chinese services Alipay and WeChat Pay give its businesses access to a huge base of potential customers.

After dropping out from Harvard and MIT, the two founded Auctomatic, an auction and marketplace management system for sellers on Ebay. Canadian company Communicate.com bought the company for US$5 million in 2008. After that, the Collisons got to work building Stripe. They’re now the most recent additions to Forbes’ list of billionaires under 40, each with a fortune of US$1.1 billion.

Stripe is far from alone in the payments arena in Asia. US-headquartered Braintree has a strong presence in the region and Europe’s Adyen is making strides here, nabbing clients like Grab and Uber (Grab also uses Stripe). Asian competitors include Thailand-headquartered Omise, which just raised US$25 million in an ICO and acquired payments solution Paysbuy from local telco DTAC.

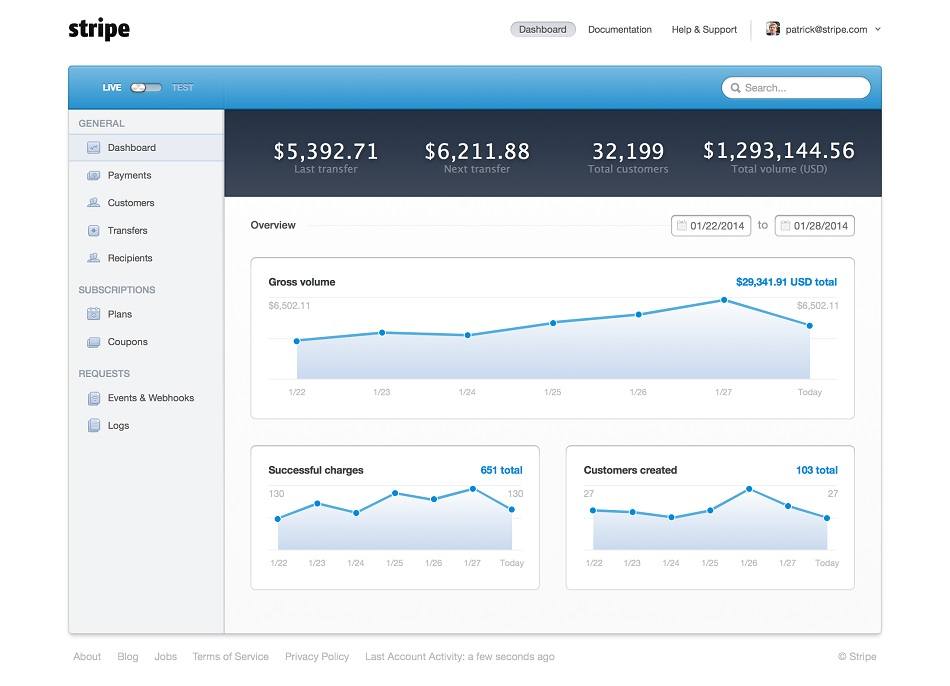

Stripe claims its edge is in the end-to-end service it provides, from its easy company setup feature to its recently announced data analytics product, called Sigma. Most of those features are available to customers through the basic dashboard, and the startup works to make them easy to use and integrate without additional hassle.

John Collison was in Hong Kong this week for the company’s local market launch and the RISE conference, so we caught up with him over the phone for a brief chat about Stripe’s Asian journey.

Below is a condensed and edited excerpt of our interview.

Stripe has grown to a US$9 billion dollar company. How has that affected your day-to-day in the company and yours and Patrick’s roles in it?

Our mission has largely stayed the same, and every new launch points to that. How we go about fulfilling that mission has changed. Now, for example, we have an engineering team of about 300 people and offices all over the world, from London to Melbourne.

Stripe is a rapidly evolving product.

These days I spend a lot of time with the product team. Stripe is a rapidly evolving product and that takes a lot of active involvement. We also spend a large amount of time with customers – just this week we held a customer lunch in Hong Kong to gather feedback on how our customers use the service, what problems they have, and so on.

To paraphrase Henry Ford, we’re not just building faster horses – we’re trying to figure out what specific needs our products serve.

What have been some key lessons from your expansion in Asian markets?

There are a few common elements we’ve observed. For example, Asia is really mobile-dominated. The tilt of the startups and the growth we are seeing leans heavily on that – companies like Grab in Singapore, ecommerce companies like Grana and HBX, are very mobile-oriented. And there are several companies developing platforms to bring offline spending to the online world.

With Hong Kong specifically, one lesson was this export orientation to US markets that local companies have. So getting our pilot up and running before launch allowed us to learn more about how to serve those businesses and help them be more successful internationally.

Paying for Starbucks using WeChat in China. Photo credit: Tencent.

You just announced deals with Alipay and WeChat Pay, China’s two largest payments providers. Does this help open the way for Stripe customers to access Chinese users? Or does it help Stripe reach customers in China?

The Alipay and WeChat Pay launch is global and it affects the businesses that are active on Stripe. Since we launched we’ve talked about this idea of enabling businesses to accept money from anyone, anywhere – China is a big part of that puzzle.

Getting the right integration and right product experience is crucial – which is why we’re offering instant integration with Alipay and WeChat Pay. This is relevant for our companies all over the world, enabling them to address the Chinese market.

How was the process working with Alipay and WeChat Pay to integrate them into Stripe?

There’s one or two components that were important. One is, we’ve been working with Alipay in some form since 2014. This kind of thing takes time to get right. And two, we have a very specific focus on the partners who need to use those services.

Patrick and I started out being developers and we know that one thing that holds back developers is the difficulty of integrating such services to their systems. Alipay and WeChat have been really good to work with and they understand the challenges involved, so that made for a seamless integration.

What is your view of the payments market in Asia? How do you see the competition, both in terms of international companies like Braintree and Adyen and homegrown ones like Omise, Ascend Money, and others?

That conversation is not new to us and being first to market is not part of our strategy. Where we compete is making it easy for new businesses to get off the ground and accept money. For a lot of companies, getting started on that still takes months rather than days. Our approach is very effective in getting more startups aboard, as they are particularly sensitive of their time to market.

There’s also the software layer – it used to be the case that if you ran a software business, you also had to have a payments component, so you’d have to get a team together to run that. We think that, much like dev ops moved to the cloud – and we’ve been beneficiaries of that ourselves, with Amazon Web Services – businesses can outsource all tasks having to do with payments, including fraud protection, marketplace tools, and data analytics, to Stripe. We don’t really see anyone else offering these types of services.

Stripe aims to make most of its products seamlessly accessible through a central dashboard. Photo credit: Stripe.

We’ve heard before how you and Patrick got into coding at a young age in Ireland, but what was it that inspired you to go after this particular problem of businesses accepting payments?

I think it is the engineer/programmer mentality – you enjoy making and fixing things. You start not by building a business or a company, but by building a product.

You start not by building a business or a company, but by building a product.

Knowing how to code when you go into entrepreneurship is definitely helpful as it shortens the way to solving problems that show up – it’s a pretty quick cycle of thinking something and being able to test it.

In our case, we weren’t looking to start a large company – we had just identified this weird problem in the world of people starting businesses but having trouble implementing payment systems.

In a way, the opportunity for Stripe was hiding in plain sight – people would say there were lots of companies tackling payments, but if you spoke to any developers, they would talk your ear off about how difficult it was.

How do you relax these days? Do you have any side projects you like working on?

I still manage to get a bit of a break from time to time. The big thing I’m into is running – it’s good as a kind of low-maintenance hobby, it’s a good way to unwind. Then I went running in Hong Kong and nearly died from the heat and humidity!

Also I’ve been meaning to do this for a while: launch a business of my own on Stripe, so I could kind of have a first-hand experience with the product. I haven’t gotten around to it yet.

This post Q&A: Stripe’s John Collison on China, the coder’s mindset, and growing globally appeared first on Tech in Asia.

from Tech in Asia https://www.techinasia.com/q-a-john-collison-stripe

via IFTTT

No comments:

Post a Comment