Image credit: Youtube.

Some might imagine that Chinese customers would rather pirate songs than pay for them. However, anti-piracy moves by the government seem to have paid off. Beyond that, China has become a fertile market for music and content streaming. It’s raking in the profits, and internet giant Tencent is leading the way.

Tencent as digital music advocate

The Great Firewall and the language barrier are forcing the Chinese to consume local content through Chinese language channels. That’s an opportunity for internet giants like Tencent, Alibaba, and Baidu to become content gatekeepers.

Out of the three giants, Tencent has the largest music streaming business with over 77 percent of the market. Tencent’s music inventory has more than 17 million songs.

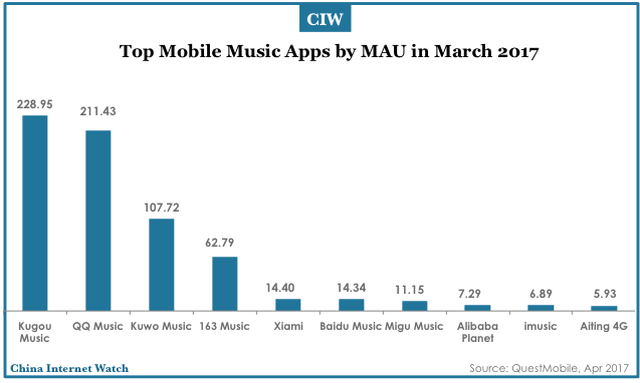

It owns the three biggest music streaming services in China: QQ Music, Kugou, and Kuwo. All of them operate independently and serve different demographics.

“The users in QQ Music tend to be living in the first-tier cities in China, whereas for Kugou and Kuwo, the users actually live in the second and third-tier cities,” said Tencent Music Entertainment Group head Andy Ng at a music conference.

The internet giant takes piracy seriously, promising to take down pirate content within an hour, he adds.

Tencent’s streaming business has seen blistering growth. According to Ng, the number of premium subscribers has increased from five million in 2015 to 15 million today. Tencent expects to hit 25 million premium subscribers by 2019.

MAU = Monthly Active Users in millions. Kugou, QQ Music, and Kuwo, all owned by Tencent, top the charts. Image credit: China Internet Watch.

Chinese users will continue to pay

Ng’s predictions may come true. Half of Chinese netizens surveyed have paid or are willing to pay for content. It’s no surprise that QQ Music is profitable while Spotify continues to bleed money.

A proliferation of lower-end smartphones from brands like Xiaomi, Oppo, and Huawei means consumers are spoilt for choice when it comes to cheap phones to access internet services. On Sina Mobile, the cheapest Xiaomi costs about US$74, while the most expensive costs US$587 – still about US$300 less than an iPhone.

QQ Music’s cheapest option is less than a US dollar per month. The low price works in China – capturing a small percent of the 83 million who live alone could generate substantial revenues for streaming businesses.

With an abundance of cheap phones and streaming packages, content streaming becomes a pastime for many young, lonely, working-class adults set adrift by work migration and singlehood. Many don’t seem to have a long-term partner. This may be a knock-on effect of China’s old one-child policy, with men now substantially outnumbering women in the country. About a third of them are aged 15 to 34 and are more likely to pay for music services.

It’s a cure for loneliness, says Jia Wei, vice president of social media app Momo Inc. Music and related content are one of the many entertainment options as they have dinner alone.

Future possibilities in streaming

While the growth of the Chinese music market is healthy, there are further areas of growth.

Music availability, especially Kpop, affects where Chinese super fans choose to stream or buy their music.

“I used Xiami because Xiami bought SM Entertainment’s stock. (SM Entertainment is a top entertainment company in South Korea.) They owned the unique copyright of songs,” April Lin, a postgraduate student from Shanghai and ex-Kpop fan says.

Alibaba owns four percent of SM Entertainment and also has an exclusive distribution deal. Alibaba-owned Xiami is Tencent’s competitor.

Chinese fan clubs are powerful for the Korean music industry. Over on QQ Music, some fans bought a Kpop-turned-Chinese-pop-singer’s album more than a hundred times to get a digital badge. The album cost US$0.75 per copy.

To boost Tencent’s song inventory, music distributor K-Digital Media (KDM) announced a deal with the Chinese company for 10 million songs during the World IT Show 2017, an ICT conference held in Seoul. World IT Show provides a platform for Asian tech companies to find Korean content and technologies to generate business opportunities.

The deal was coordinated by the Korea Association for ICT Promotion (KAIT)’s Global ICT Partnership Program, which matches Korean startups and companies with foreign partners in the IT industry.

KDM owns over 12 million songs, 10,000 movies and music videos, as well as Kpop production capabilities including 2000 composers and producers. QQ Music, Kugou, and Kuwo listeners will have a lot more content to look forward to.

Social ecosystem

Tencent’s bet on Korean content makes sense given its dominance via WeChat. The Korean music industry has successfully merged with social sharing, which entrenches users as loyal customers.

Korean musicians win awards by ranking high in physical album sales, digital charts, broadcast top lists, Youtube views, and netizen votes. Social media, such as Weibo and Twitter, are means to canvas support and build camaraderie with fans.

Through social media, Chinese admirers can amass their power to buy multiple albums or stream music 24/7 via paid accounts on foreign music sites.

Melding music with social means that more music-related opportunities become lucrative: live streams, TV shows in various formats, advertisements, and up-close-and-personal events. It’s an ecosystem that keeps on giving.

Already, sites like QQ Music offer paid members concert tickets, exclusive content, and events.

If Tencent acquires more Korean songs and content, their hold over the Chinese music market will continue.

This is part of the coverage of the World IT Show 2017.

This post Why China’s music streaming is leading the world appeared first on Tech in Asia.

from Tech in Asia https://www.techinasia.com/china-korea-digital-media

via IFTTT

No comments:

Post a Comment