Photo credit: Tiger Pixel.

Raising capital as an entrepreneur is no cake walk. At its worst, it’s a grueling slog of pitching, networking, meetings, and waiting. But for blockchain-savvy startups, fundraising has never been easier – or faster – than in the current boom time.

Last week, Israeli blockchain startup Bancor raised more than US$127 million in three hours. In May, a web browser called Brave pulled in US$51 million in less than 30 seconds. Scores of other projects have seen similar success, with millions of dollars’ worth in cryptocurrency, such as bitcoin, pouring in after just a few days.

Welcome to the Wild West of ‘initial coin offerings’ or ICOs, a crowdfunding model made possible by blockchain technology.

Here’s how it works. Comparable to Kickstarter – but uniquely different – ICOs pool funds from numerous backers who are interested in a project. Funds are paid and collected on the blockchain, a distributed database powered and verified by a peer-to-peer network of computers. Support for an ICO typically comes in the form of bitcoin or ether, the cryptocurrency behind the Ethereum blockchain.

You buy a coin for 100 dollars worth in cryptocurrency and hopefully you can flip it to 200.

However, instead of promising a thank-you mug or some kind of product in exchange for cryptocurrency, ICOs give supporters digital tokens that are specially minted for the project at hand. Brave, for instance, sold Basic Attention Tokens for its web advertising system during its ICO. Messaging app Kik plans to sell Kin tokens – the company’s cryptocurrency – when it launches its token crowdsale. Depending on the success or popularity of the project, these tokens can then be resold for a higher value on secondary markets.

In that sense, they’re kind of like stocks (caveats to this analogy later), but without any legal strings – or protections – attached.

“You buy a coin for 100 dollars [worth in cryptocurrency] and hopefully you can flip it to 200. You do not really care about the underlying technology,” says Lio Lionello, co-founder of engineering services firm Enuma Technologies, explaining the mentality of many ICO backers.

“Of course, the better that technology, the higher chance that other people think it’s viable and therefore appreciates,” he says.

More than money

If the idea of spending tokens to buy other tokens sounds bonkers, consider ether’s meteoric rise. When Ethereum launched in 2014, bitcoin holders could buy 2,000 ether for a single bitcoin. That put ether at less than a dollar per token.

Today, the digital currency is valued at around US$330 apiece. Call it a bubble, but that’s the dream powering a lot of the craze behind ICOs. According to blockchain publication CoinDesk, ICOs have raised a whopping US$327 million so far this year. Even venture capital firms have cashed in on the action, with one raising US$10 million to invest in blockchain startups.

“Everyone’s aiming for the sky,” says Shaun Djie, co-founder of Digix Global, a Singaporean startup that tracks gold assets on the blockchain. Last March, Digix launched its own token crowdsale, hitting its goal of US$5.5 million in less than 12 hours.

The current ICO market is overheated. The valuation is way off.

“There’s a lot of retail investors trying to come in without really appreciating the technology and what it does, but more looking at it as an alternative asset class,” explains Djie. A year ago, companies would have to convince others of their idea in order to be successful. Today, that’s not always the case, he says.

“The current ICO market is overheated. The valuation is way off,” agrees Eric Gu, founder of Viewfin, a Shanghai-based startup that raised about US$2 million in its crowdsale last August.

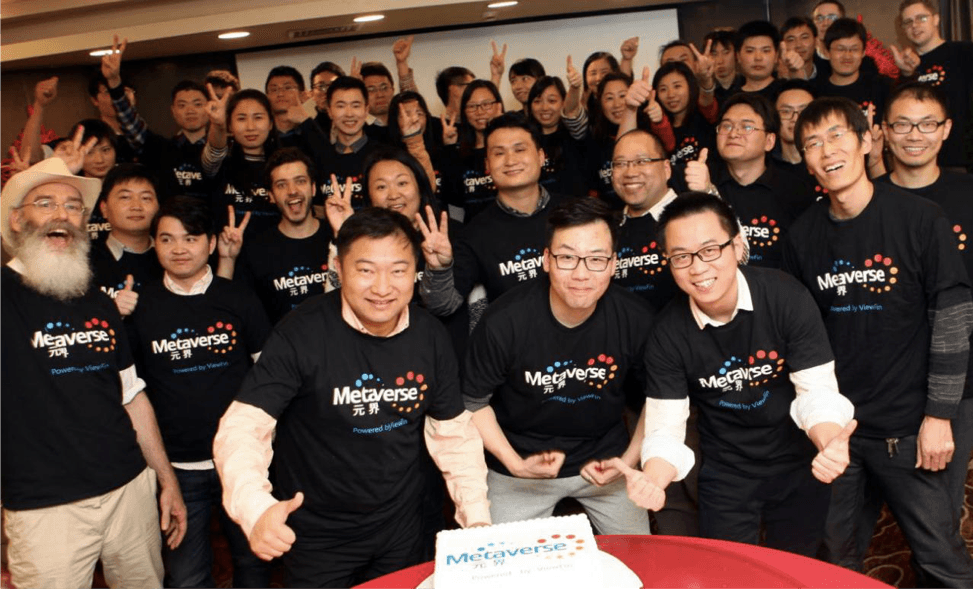

Whether or not an ICO is successful mostly has to do with its timing, not so much “how good your project is,” he says. That’s why Viewfin rushed out its Metaverse ICO after just one month of preparation – Gu says he had a gut feeling that the ICO market would cool later that autumn.

Photo credit: Viewfin.

For people out to make a quick buck, that might not sound so bad as long as you’re riding the bubble before it bursts. But token crowdsales aren’t always just about the money. Unlike corporate bonds or stocks, tokens have utility. They often have a function within the company’s product, whether they’re part of a payment system, such as Kik’s digital currency, or a way to track gold assets.

“We could have raised money from the traditional financial sector, but […] we didn’t just need money,” says Patrick Dai, CTO of Singapore-based Qtum, which raked in US$54.5 million after an ICO in March. “What we needed more was broad participation from the community.”

Indeed, a project’s success might depend on how many people own and believe in its tokens. In Kik’s case, if no one buys into the Kin token system, its payment program to incentivize developers will flop. For Qtum, a blockchain project that aims to combine elements of bitcoin and Ethereum, attracting developers from the get-go to build useful services on top of Qtum is essential.

By nature, ICOs are a way to seed a project’s first group of users. Once the crowdsale ends, companies can follow up with supporters and cultivate a larger base of users. Djie says Digix talks to its community members on an almost daily basis via Reddit, WeChat, and Slack, with almost 2,000 members in its Slack channel.

ICOs are a way to seed a project’s first group of users.

“One way to think about the token model is to imagine if the internet and web hadn’t been funded by governments and universities, but instead by a company that raised money by selling off domain names,” said Chrix Dixon, general partner at Andreessen Horowitz, in a Medium post about cryptocurrency. “People could buy domain names either to use them or as an investment (collectively, domain names are worth tens of billions of dollars today). Similarly, domain names could have been given out as rewards to service providers who agreed to run hosting services, and to third-party developers who supported the network.”

“This would have provided an alternative way to finance and accelerate the development of the internet while also aligning the incentives of the various network participants,” he wrote.

Digix Global’s core team (left to right): Shaun Djie (CCO), Anthony Eufemio (CTO), KC Chng (CEO) and Chris Hitchcott (core developer). Photo credit: Digix Global.

Moving forward

To be sure, it’s early days for ICOs. To date, there are no specific laws laid out for token crowdsales, which take care to avoid falling within the scope of securities. That would place it under the scrutiny of institutions like the US Securities Exchange Commission, which is why companies often emphasize that tokens are not equity and supporters are not shareholders.

Some startups will also choose to launch their ICO in Singapore or Switzerland, where governments have adopted a more open attitude towards cryptocurrency and blockchain projects.

“In China, the legal specifications are gray. They’re not clear,” says Roland Sun, legal advisor to blockchain startups like Qtum and partner at Broad & Bright, a Shanghai-based law firm. “In Singapore, the government is more efficient. You can engage the local government, you can approach them.”

Before launching its ICO, for instance, Qtum was able to communicate directly with the Singaporean government, which approved its crowdsale under two conditions: that Qtum conduct know-your-customer or KYC processes to verify the identity of supporters while making sure to protect their privacy.

The tokens are going through a tulip mania.

There’s also little legal protection for crowdsale supporters, if any. Last June, one of the largest crowdfunding projects in blockchain history called the DAO (Distributed Autonomous Organization) was hacked. The perpetrator managed to extract about US$50 million in ether, according to currency exchanges at the time, before core developers of Ethereum stepped in. In the aftermath of the DAO, there was no legal recourse, only a technical reset of Ethereum’s code.

“When you buy a stock in a company, there’s dividends, there’s accountability, there are reports that a company has to provide to the investors. There are protections in place,” says Lionello, whose firm conducts due diligence on ICOs for clients, among other services. “ICOs have no such thing.”

“Without those same protections that have been put in place in shares, the tokens are going through a tulip mania,” he says, referring to a speculative bubble during the 17th century when prices for tulip bulbs skyrocketed before crashing.

In particular, most investors have few means to gauge the legitimacy and risk of ICO projects. A typical crowdsale will include information about the team as well as a whitepaper explaining the technical details of the project. Gu, who calls himself a professional ICO investor, says that vetting ICOs is difficult for “the average Joe.”

“Personally, I’m very well-connected in this community, domestically and abroad. I actually know people so I can do my own due diligence,” he says. But many investors, especially those incapable of poring through technical whitepapers, have to rely on word-of-mouth information, he says.

Qtum team members. Photo credit: Qtum.

Still, despite its flaws, there’s no doubt that ICOs open new possibilities for how companies and individuals raise capital and fund their work, especially as the model evolves through its many growing pains.

For instance, as the token crowdsale model matures, it’s possible that smaller, micro-sales could become more prevalent. Like Patreon, the micro-sales model means project teams raise small but regular amounts of capital instead of massive, single rounds. After all, unlike an initial public offering, there’s no limit to the number of times an organization or individual raises an ICO.

That would give investors the opportunity to observe the performance of certain projects before throwing in large amounts of capital. Angelshares and Mysterium have already trialed micro-sales, as referenced in a detailed analysis of token sales by Vitalik Buterin, co-founder of Ethereum.

ICOs also have the potential to distribute company and project ownership more widely than venture capital. Of course, the fine curation of investors at VC firms comes with its own strengths, such as access to strategic partnerships and mentorship. Still, the idea that more people can benefit from the growth of successful companies is compelling.

“Those who ultimately profited from large companies like Alibaba were large investors, such as Softbank or IDG,” says Dai. “But the investors of Ethereum – those who profited – were normal, everyday people.”

ICOs or token crowdsales give “everyone the chance to participate in the early stages of a product,” he adds.

Currency converted from Ether, Bitcoin, and RMB. Rate: US$1 = ETH 0.0029544567 = BTC 0.00038 = RMB 6.83.

Note: In this article, we have converted the total amount of cryptocurrency (bitcoin and ether) completed by Bancor, Qtum, and Brave’s crowdsales into dollars. However, that does not mean that they have already converted everything into fiat currency, as different companies have their own plans for how they hold their money (ex: some may choose to convert a certain percentage, while keeping the rest in bitcoin, ether, etc.).

This post Startups are raising hundreds of millions in hours with ICOs, but can the party last? appeared first on Tech in Asia.

from Tech in Asia https://www.techinasia.com/ico-overview

via IFTTT

No comments:

Post a Comment