Chinese tourist using Alipay in Japan’s Kansai International Airport. Photo credit: Ant Financial.

Airbnb is doubling down on China this year, where it has been slow to expand. But it faces a strong rival there – Chinese unicorn Tujia which lists over 400,000 properties, five times that of Airbnb which is confined mostly to major cities.

In the first part of this series, we looked at why Airbnb struggles in China, and how Tujia altered the classic Airbnb model to dominate the Chinese market for alternative travel accommodation. Today, we zoom out to see how Tujia is now widening the war with Airbnb across Asia.

Surge of tourists from China

The secret to Tujia’s international aspirations lies in the throngs of Chinese tourists traveling abroad. China now leads the world in outbound tourism, thanks to economic growth and rise in spending power. Passports became much easier to get too, as China started trading with the world.

Last year, 135 million Chinese travelers went abroad and spent US$261 billion.

Last year, 135 million Chinese travelers went abroad and spent US$261 billion. Tujia targets those among them who like to go on vacations to tourist destinations adjacent to China.

“We see that as a huge opportunity for us, because what we do is suited for people going on vacation, where they stay at one location for multiple days,” Tujia president Hai Zhuang explains.

Tujia president Hai Zhuang. Photo credit: Tujia.

For extended stays, it’s nice to have a kitchen, washing machine, and some extra space, instead of being cooped up in a hotel room. “I have two daughters. It’s not possible for my family to fit into a hotel room. When I travel with my family outside, it’s usually Airbnb, and inside China, it’s Tujia,” says Hai.

But soon, Hai won’t need Airbnb except when he goes West. His company is busy lining up properties for Chinese vacationers to stay in Japan, South Korea, and popular destinations across Southeast Asia.

These include both shared accommodation a la Airbnb as well as the model Tujia has found works better in China, where most people are not so comfortable letting strangers into their homes. The Chinese company has become adept at providing travelers with short-term rentals of apartments or villas, which could be little-used second homes, unoccupied properties bought for investment, or even new properties from real estate developers.

See: How Tujia altered the Airbnb model in China – and why Airbnb hasn’t adapted

Tujia’s adaptability

The nature of the accommodation depends on local regulations, too. For example, it’s illegal to rent out a room or apartment for less than six months in Singapore, although you do find many listed on Airbnb. The local authority is considering a proposal to allow short-term rentals for some types of properties.

Japan recently passed a new law to legalize short-term rentals, with some stipulations – such as requiring hosts to notify neighbors and respond promptly to their complaints. The legalization is music to the ears of Airbnb, which already had thousands of listings in Japan, as well as new entrant Tujia.

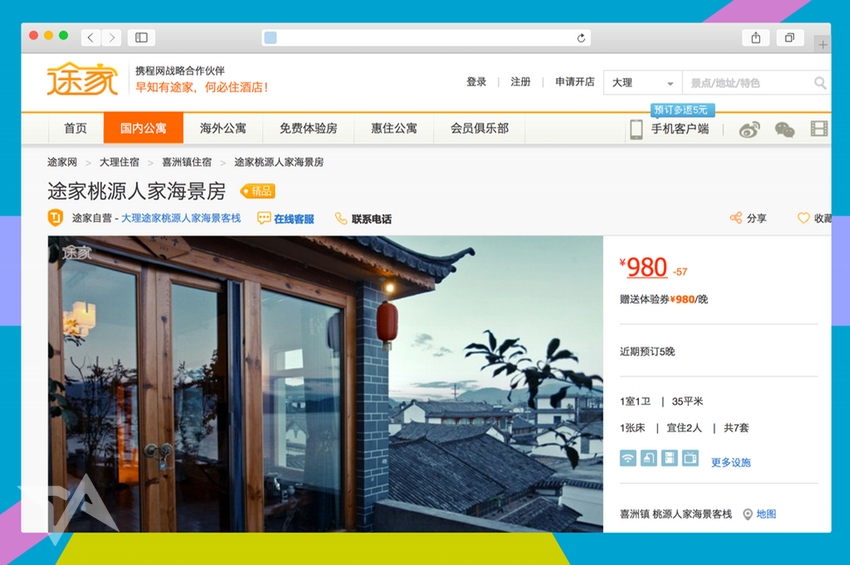

Tujia’s website shows a holiday home rental for US$160 per night.

For Tujia, its flexibility of renting models and more hands-on approach to managing listed properties [described in detail in the first part of this series] could be an advantage not only in China but other Asian markets which share similar characteristics. People in Japan, and even touristy Thailand, Malaysia, or Indonesia, are typically more insular towards home-sharing compared to their counterparts in the West.

An advantage for Tujia is that its target group of Chinese travelers are more familiar with Tujia than Airbnb.

Another advantage for Tujia is that its target group of Chinese travelers are more familiar with Tujia than Airbnb, as of now. Trust is a huge factor in choosing to stay in a stranger’s home for a vacation.

There’s also the convenience of integration with Chinese mobile payment systems like Alipay and WeChat Pay. For example, almost one-third of Thailand’s foreign tourism revenue came from Chinese travelers last year, and WeChat Pay has partnered with banks and mobile payment services in Thailand to make local shopping convenient for its users. And WeChat Pay had a six-fold year-on-year rise in transactions in Thailand in the first quarter of this year, according to Tencent.

See: Chinese tourists are bringing their wallets – and China’s tech giants – overseas

The surge of cross-border tourism to and from China is also the reason why Airbnb is so interested in stepping up its act there. Although the renaming of its China unit to Aibiying (‘welcome each other with love’) backfired because of its sexual innuendoes in Chinese, Airbnb points out that outbound travel from China grew 500 percent in 2015, “making China one of the fastest growing outbound markets for Airbnb.”

Regional variations

Photo credit: Chinese Tourists.

The favorite destinations for Chinese tourists are in Asia, especially Japan, South Korea, and Thailand, according to the World Tourism Organization. These are also the places abroad which are most familiar to the Chinese, and so they don’t hesitate to stay in a home instead of a hotel for a vacation, adds Hai.

These regional markets are where Tujia feels it will have an edge in competing with Airbnb. It is building up teams in Japan, South Korea, Taiwan, Singapore, Thailand, Malaysia, and Indonesia. And it has already signed up nearly 40,000 properties outside China.

Why not in neighboring India, I ask Hai, who was on a visit to Delhi to attend a Phocuswright conference when I met him. After all, the giant neighbors have been opening up to one another in recent times after decades of geopolitical tensions between the two.

See: Alibaba and the 40 founders from India

It’s still early days for Tujia to target India as a market, says Hai. Firstly, India is an unfamiliar land to most Chinese travelers. And “if I go to a place I’m not familiar with, I’ll probably stay in a hotel,” not in an Airbnb or Tujia.

Secondly, even if tourism picks up between India and China, thanks to a growing rapprochement, it will be a first visit to India for most Chinese travelers. And they’re not likely to stay for more than a day or two in any place. That’s not ideal for Tujia.

What we do is suited for people going on vacation, where they stay at one location for multiple days.

“If they come for the first time, they will want to see a lot of places – Delhi, Mumbai, the Rajasthan desert, the southern beaches, and the grand mountains of the north. They will not stay in one area for a leisurely vacation,” explains Hai.

So, even though Tujia can gain from its experience in the Chinese market and connection with Chinese travelers, it also has to adapt to each regional market’s peculiarities. For example, “in Japan, the host will expect you to clean up everything before you leave the property,” says Hai. “In China, that’s rarely the case; the host is expected to take care of everything.”

An understanding of customer expectations at such a granular level will be a key part of winning battles against Airbnb in Asia. Tujia is banking on its more hands-on approach to give it the edge. More than a fifth of its properties abroad have been signed on directly, rather than via local travel operators, to make sure it can set high expectations and manage them well.

This post Airbnb’s Chinese rival Tujia widens the war to Asia. The unicorn has an ace up its sleeve. appeared first on Tech in Asia.

from Tech in Asia https://www.techinasia.com/airbnb-chinese-rival-tujia-widens-war-to-asia

via IFTTT

No comments:

Post a Comment