Indian festival Holi celebrates the beginning of spring and the triumph of good over evil. Photo credit: Steven Gerner.

2016 saw a sharp fall in funding for Indian startups, sending jitters through all stakeholders in the ecosystem. But they’re breathing easier now because it appears to have been a correction rather than a loss of faith in the India story.

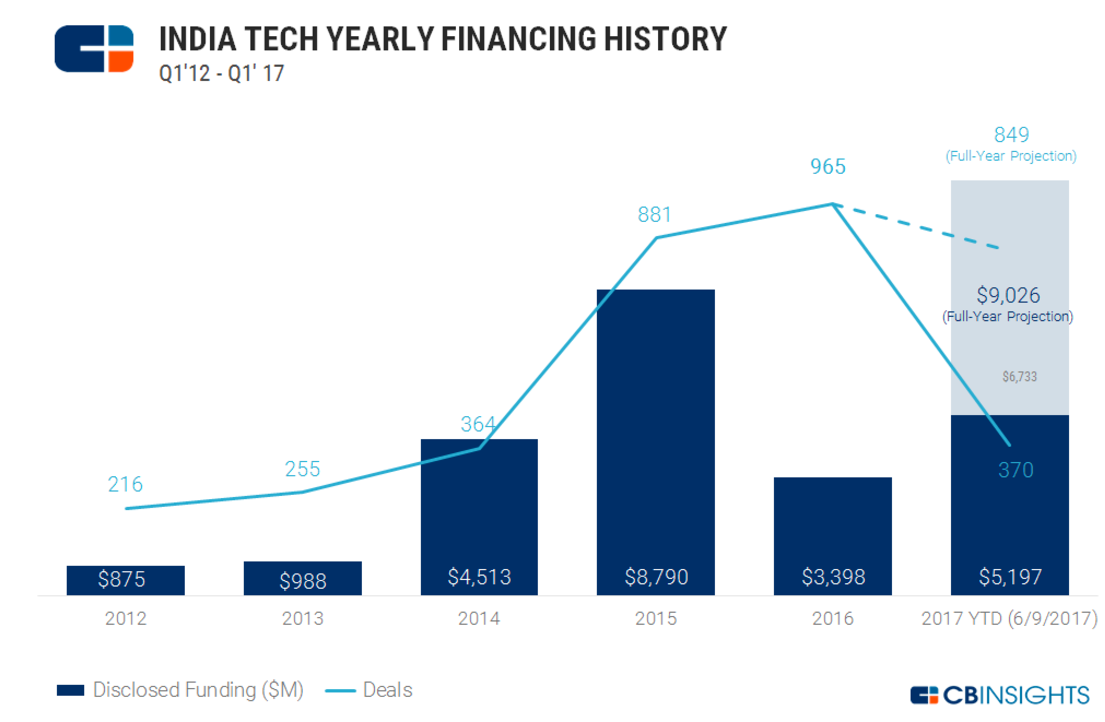

The latest data midway through 2017 shows that funding has already crossed the total funding for 2016 to reach US$5.2 billion. At this rate, it will also cross the US$8.8 billion raised in the boom year of 2015 to reach a new record level, according to venture capital research firm CB Insights.

Mega funding rounds are back after nervous hedge funds fled the scene last year. The biggest ones were a US$1.4 billion round for ecommerce site Flipkart, led by Tencent, Microsoft, and eBay, followed by a matching US$1.4 billion for Alibaba-backed ecommerce and mobile payments company Paytm from a single investor, Japanese giant SoftBank. These were part of a realignment of the ecommerce scene, with Flipkart negotiating the buyout of Indian rival Snapdeal while global rival Amazon continues to pump money into its Indian arm.

See: How the latest $1.4b Flipkart funding changes the ecommerce game in India

Ride-hailing app Ola, meanwhile, notched up US$404 million of additional funding in multiple rounds this quarter, while its global rival Uber scrambles to deal with issues of sexual harassment and leadership.

Compared to all this activity, 2016 was tepid indeed, with its biggest funding round being US$200 million to keep the struggling Snapdeal afloat long enough for its sale.

But while the return of mega-deals has hogged the headlines this year, early stage deal flow has picked up smartly too. CB Insights data shows 370 disclosed deals in India this year, as of June 9. That run rate will take the total number of deals for 2017 close to the numbers for the previous two years.

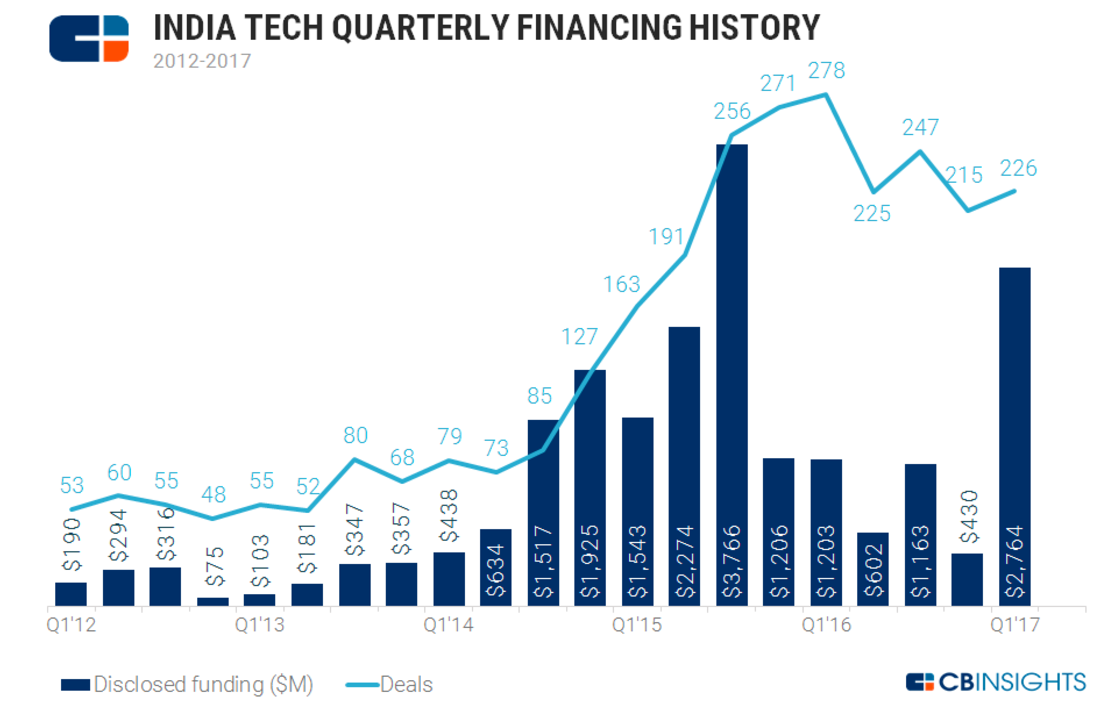

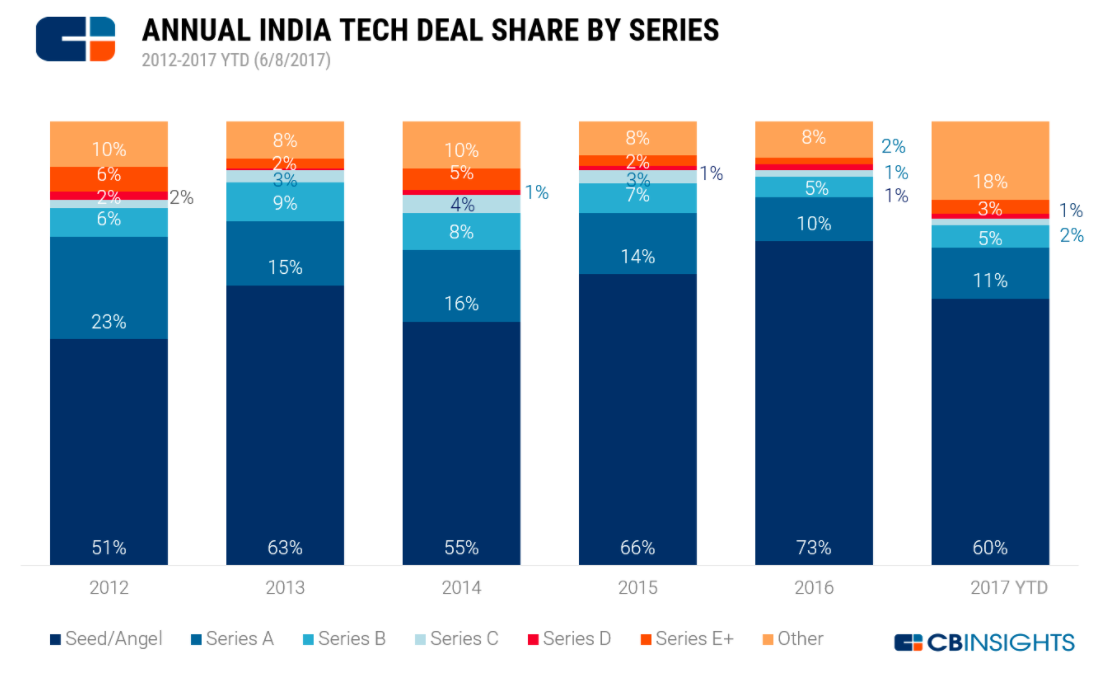

Deal flow has trended downwards, however, since hitting a high of 278 in the first quarter of 2016. More so for series A rounds, which account for 11 percent of all deals so far this year, which is one percentage point more than last year’s number but lower than the level of 2015.

See: 25 failed startups in India and what you can learn from them

Entrepreneurs, angels, and seed funds will be hoping for an uptick in series A rounds for the latter half of 2017, to stem the shutdown of startups starved of funds. With more attention now being paid to viable business models and a path to profitability, India may see a return of confidence sooner than later, judging from the funding trends of the first half of 2017.

This post After a steep fall in 2016, India is on track for a record funding level this year appeared first on Tech in Asia.

from Tech in Asia https://www.techinasia.com/india-startup-funding-h1-2017

via IFTTT

No comments:

Post a Comment