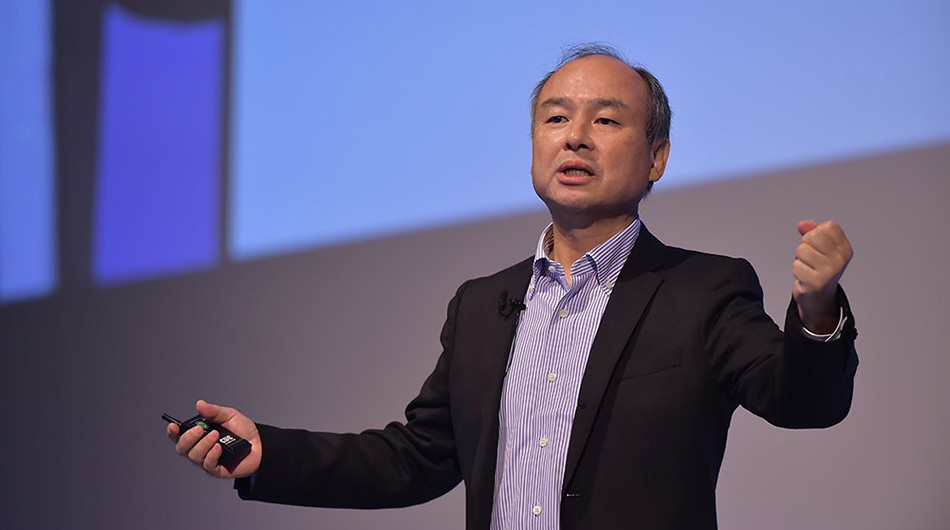

Masayoshi Son at SoftBank World 2016. Photo credit: @SoftBank.

The news

- SoftBank’s $93 billion tech fund, which is the largest ever, has set off alarm bells of crazy valuations and mega funding rounds skewing the startup scene as it did in 2015. For example, the Japanese giant had to write down its mega investments in India’s Snapdeal and Ola last year.

- Another valuation boom is evident in a US$502 million round for a little known VR startup in the UK, called Improbable Worlds, which became a unicorn overnight after being valued at US$100 million earlier. The US$1.4 billion funding of Paytm – the largest by a single investor in India – is another example.

See: Funding roars back in 2017

Why it matters

- SoftBank’s mammoth war chest can make the playing field uneven for other startups and investors, leading to distortions as huge bets are placed on visions rather than metrics. Startups getting the windfall may also go off balance with sudden scaling up.

- The so-called Vision Fund brings together a diverse conglomerate of Apple, Google, Qualcomm, Sharp, Foxconn, and the sovereign funds of Saudi Arabia and the UAE. They could consolidate forces across a range of applications of complementary new age technologies like AI, IoT, and VR, shutting out competition – or they could have conflicting interests, affecting how the capital is deployed.

- Masayoshi Son’s $20 million early bet on Alibaba – now worth US$90 billion – attracts investment partners to his mega fund, but it’s also a massive risk for his company as SoftBank carries a US$125 billion debt.

Sources: The Information, Bloomberg

This post Brief: SoftBank’s $93b vision fund triggers fears of another startup valuation bubble appeared first on Tech in Asia.

from Tech in Asia https://www.techinasia.com/softbank-vision-fund-triggers-fears-of-tech-bubble

via IFTTT

No comments:

Post a Comment