Photo credit: Adyen.

Uber processes millions of transactions a day. It’s a miracle given how big a patchwork the payment network is. Imagine a cross-country trip at the speed of light: you pass from one jurisdiction to another, with tolls along the way emptying your pockets.

Uber and other well-known tech companies like Airbnb and Netflix rely on Dutch payments firm Adyen to navigate the complexity. Adyen isn’t recognized by consumers because it’s the hidden pipes enabling online transactions.

What merchants “don’t want is a payments company coming in and branding themselves,” says Warren Hayashi, Adyen’s president for Asia Pacific. “The more invisible we are in the checkout process, the more we’re serving our customers.”

Adyen is huge. It processed US$56 billion in payments in 2015, doubled its revenue to US$371 million, and made US$45 million in profit.

It’s valued at US$2.3 billion and has raised money from Iconiq Capital, a fund which counts Facebook founder Mark Zuckerberg and LinkedIn founder Reid Hoffman as investors.

In August, Uber’s Southeast Asian rival Grab picked Adyen as its payment provider in Indonesia, Philippines, Thailand, and Vietnam. Grab uses Stripe for the rest of its markets.

For a company to have both competitors as its customers in Southeast Asia speaks to the product’s robustness.

What distinguishes Adyen from them, though, is this: Adyen is profitable while Uber and Grab bleed their eyes out.

Uber reportedly lost US$1.2 billion in the first half of this year alone. With driver costs forming the bulk of its losses, critics wonder if it can stay afloat long enough to see the mass adoption of self-driving cars.

Grab’s partnering with nuTonomy on self-driving tech, but finds itself in the same predicament.

What makes Adyen compelling?

Meanwhile, Adyen feels like a company that’s built to last. The firm positions itself as the payment provider for fast-growing enterprises that are expanding globally. It’s entirely business-facing, which means it doesn’t need to wait for network effects to kick in like PayPal did in order to make a profit.

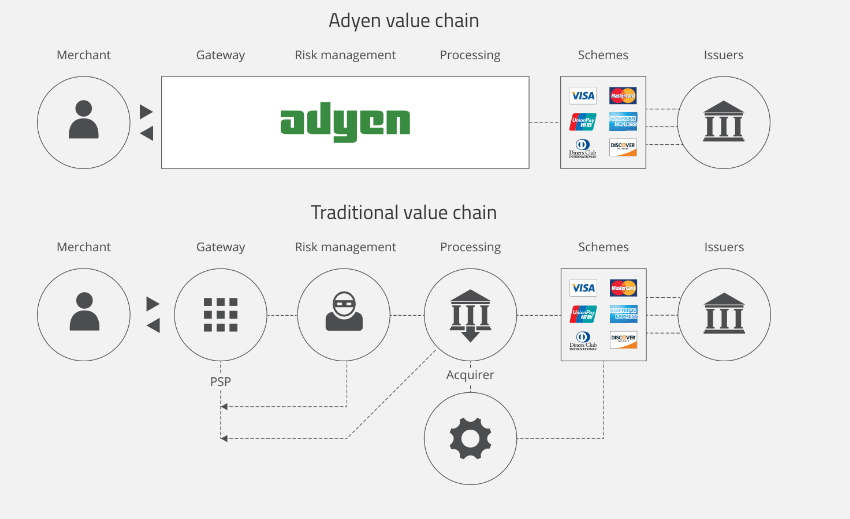

While firms frequently have to deal with payment gateway, risk assessment, and payment processing systems separately, Adyen puts these functions under one roof. This simplifies things for customers, giving them visibility to data across the entire process.

“Because there’s a full set of data that comes back, we have about 100 reasons why transactions get declined. Typical merchants only get to see about 30,” says Warren.

By penetrating the opaque payments cloud, Adyen can make adjustments to increase the payment approval rate by a few percentage points. Having these functions in one entity also means fewer players would extract profit for themselves. The end result is cost savings for merchants.

Another attraction for customers is that Adyen is payment agnostic. It accepts over 250 online and offline payment methods globally, from PayPal worldwide to Nets in Singapore and Alipay in China. It can add more methods depending on what becomes popular, effectively evolving with the landscape.

Adyen’s rival Stripe (which Grab also uses) only accepts credit cards, restricting it to countries with high credit card penetration.

This makes Adyen valuable in parts of Asia and Europe, where payment methods vary from country to country.

While Adyen listens closely to clients to craft its product roadmap, it insists it doesn’t do bespoke work. It’ll only implement feature requests if it addresses a larger need other customers have.

“The best way to scale a payments platform is to minimize the amount of bespoke work,” says Warren. “That always comes back to haunt you.”

Converted from Euros. US$1 = €0.98.

This post Meet the startup that has both Uber and Grab as customers, and might outlast them appeared first on Tech in Asia.

from Tech in Asia https://www.techinasia.com/meet-startup-uber-grab-customers-outlast

via IFTTT

No comments:

Post a Comment